When I first heard about the FIRE movement, my mind was blown. I was ecstatic to hear there was an entire movement based on regaining control of your time by mastering your money. So I dove in headfirst, consuming anything I could find about early retirement and financial independence.

As I progressed through my FIRE journey, I began to hear whispers of different branches within the FIRE movement, from fat FIRE to lean FIRE, slow FIRE, and my all-time favorite, coast FIRE.

I took a step back and thought about what I wanted in life. Did I want to continue busting my tail, saving over half of my income, and reaching full FIRE by my mid to late 30s, or was there something else that might be a better fit?

When my daughter was born, the answer became as clear as day.

I wanted my freedom now. I wanted to go on long morning walks, eat breakfast, lunch, and dinner as a family, and spend as much time with my daughter and wife as possible. I heard other parents talk about how fast it flies by, how you only have 18 summers with your kids, and how my daughter and I will have spent roughly 93% of our in-person time together by the time she graduates high school. The answer was clear—I wanted to maximize the time now.

At best, standard FIRE couldn’t give me that freedom for another 6-10 years. But coast FIRE could give me the majority of what I wanted right now. So I decided it was time to convert from devout standard FIRE to devout coast FIRE.

Hallelujah!

So here you have it, ten reasons why I think coast FIRE is the best FIRE:

1. You can reach coast FIRE much quicker than most other forms of FIRE.

When I reached my coast FIRE number at 29 years old, I had to make a decision. I could start coasting now, enjoying many of the benefits of a FI lifestyle today, while still needing to work to cover living expenses. Or, I could hang on, working at this same pace for another 6-10 years to reach full financial independence and never need to work again.

When my daughter was born that year, the answer was clear: I wanted to enjoy my freedom now.

One of the most significant benefits to coasting is that you can typically reach your coasting number in a fraction of the time it would take to reach full FIRE, allowing you to step into a FI lifestyle ASAP.

To put it in perspective, at my age, with a target of spending $50k per year in retirement, I would need $1.25 million to be full FIRE, using the 4% rule. In contrast, to start coasting with those same spending targets and a retirement age of 67, I would need just $235k to start coasting. That’s a staggering 81.2% less I would need to start coasting versus achieving full FIRE.

2. It is a more sustainable approach to FIRE.

One of the biggest complaints I’ve heard about the FIRE movement is there’s an unhealthy binge and purge relationship with work. As a result, countless FIRE’ees have found themselves burning out on their way to FIRE—working relentlessly to reach their FIRE number as fast as possible in hopes of quitting work altogether. While this approach may be a good fit for some, it’s not great for everyone and leaves much to be wanted in terms of balance and sustainability.

Coasting to financial independence offers a much more balanced, mindful, and sustainable approach to financial freedom. Rather than working to the point of burnout, coasters can take their time, working flexibly on their terms while designing and living their unique FI lifestyle today. It’s the age-old story of the tortoise and the hare, where slow and steady wins the race.

3. You continue working, which can have many benefits.

Part of my evolution on my journey to FIRE came when I started looking into the “dark” side of retirement. I found countless stories of retirees, young and old, losing their sense of purpose, fulfillment, and value once they exited the workforce.

Like it or not, the workplace can provide many benefits, from personal fulfillment and value to social interaction, and exiting the workforce entirely can negatively impact retirees of any age. Of course, that’s not to say we should all continue working no matter what and forgo FIRE altogether, but it’s simply an invitation to recognize some of the benefits that come with work.

By choosing to coast, you get to experience many of the benefits that work provides while working at a pace that suits you and your goals.

4. Most people will continue working after reaching full FIRE anyways.

Show me someone that’s reached FIRE, and I will show you someone that still does paid work. Pete Adney from Mr. Money Mustache, Paula Pant from Afford Anything, Brad and Jonathan from Choose FI—they’ve all reached their FIRE goals, and they all continue to do paid work, albeit self-employed paid work.

Once I realized that even if I reached full FIRE, there was absolutely no way I would want to stop working for the rest of my life, full FIRE started to lose its appeal. Why would I grind to reach my full FIRE number if I wasn’t interested in never having to work again?

I realized that all I wanted was the opportunity to create a flexible work schedule that fit my lifestyle. Sure, I didn’t want to work 40 hours a week, but I did not want to stop working altogether. So for me, the sweet spot has been right in the middle—still working, but on my terms, doing the things I enjoy, at a slow and steady pace.

Coasting embraces the truth that you don’t actually want to stop working altogether—you just want options. Once you realize that, full FIRE starts to look a lot less appealing, and coasting takes center stage.

5. Young people can reach their coasting number much easier.

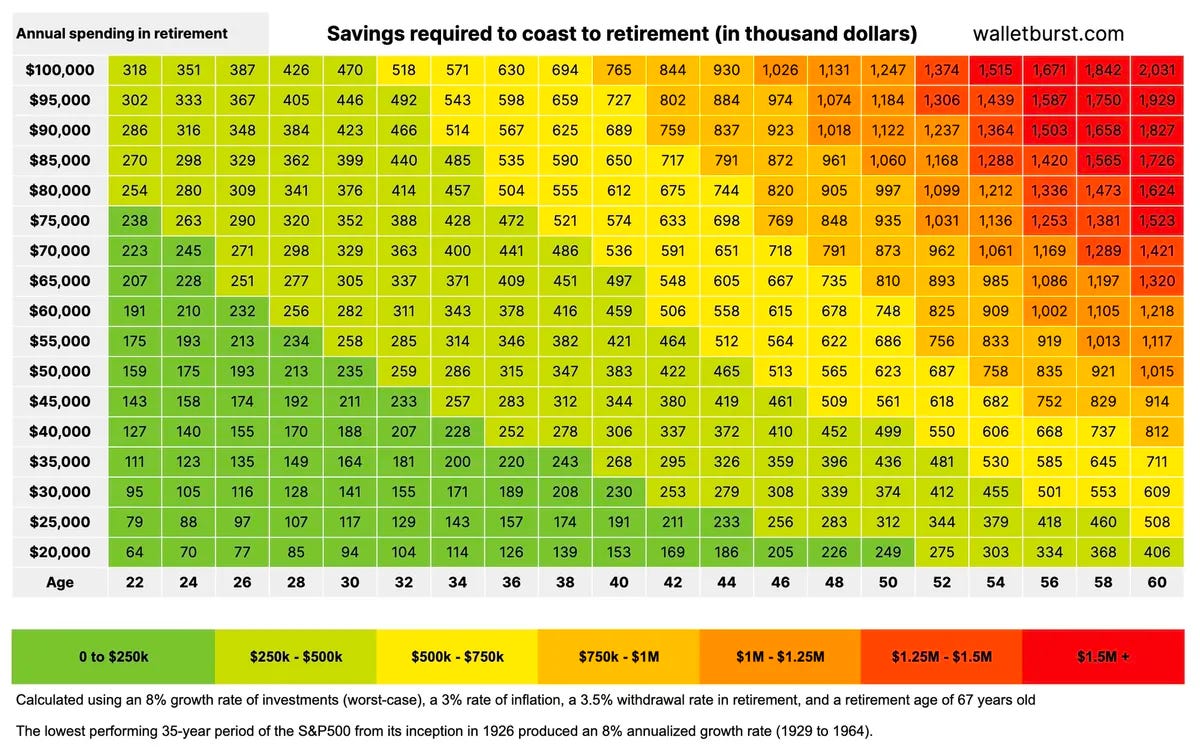

If you’re young, coasting can be a superpower. Check out this Coast FIRE grid by Wallet Burst shown below. On the left-hand side, you’ve got your annual spending needs in retirement, and on the bottom, you’ve got your current age. When you line those two up, you get the amount you need to start coasting in thousands.

If you’re 22 years old and want to spend $50k per year in retirement starting at age 67, you only need $159k to coast to financial independence. Contrast that with full FIRE, where you would need 1.25 million at least to provide $50k per year using the 4% rule.

Even if you’re 30 and have that same spending target, you only need $235k to start coasting, knowing that your retirement needs are fully met.

6. Coasting lets your money do the majority of the heavy lifting.

Part of the reason that coasting is so attainable is that it lets the exponential power of compounding do the heavy lifting. So rather than grinding away at work to earn extra money that you can stuff into your 401(k) to reach FIRE quickly, coasting is all about stuffing the money in and then taking a step back while it does the work for you.

Working flexibly from now until your desired retirement age gives your money time to build and grow and eventually support the entire FIRE lifestyle you are working towards.

One way that I have heard it described is that coasting means you get to coast, not your money—your money is putting in hard work behind the scenes while you get to enjoy yourself—a win-win.

7. It is incredibly flexible and scalable—you can coast for a bit, then pivot back.

Two of the best aspects of coasting are flexibility and scalability. Once you’ve reached your coast number, you’re free to work as much or as little as you need to cover living expenses. That means that if your living expenses go up, you can work more to cover them, and if they go down, you can scale back work accordingly. This gives coasters many different options in their work arrangement and lifestyle choices, knowing that they can add or decrease work as needed, assuming they’ve designed a work setup that will allow it.

In addition, there’s no reason why you couldn’t coast for a while, doubling down on freedom and flexibility while your kids are young and in the house, and then pivot back to pursuing full FIRE after your kids are grown and out of the house. Again, coasting leaves your options open—the sky's the limit.

8. There are fewer risks of depression and social isolation.

You don’t have to spend long in the FIRE Reddit forums to find stories of depression and social isolation due to either pursuing FIRE or achieving FIRE. Unfortunately, FIRE can lead some to aggressively cut back their lifestyle to attain FIRE as quickly as possible, which leads to possible social isolation. In addition, many people find that once they’ve achieved full FIRE, things start to lose their appeal due to a lack of motivation since you’ve already “beat the game.”

While there is no doubt that you can still experience social isolation and depression when coasting, I think those risks are mitigated because you aren’t as incentivized to slash expenses to the bone, and you are still getting the positive benefits from being part of the workforce.

9. You will increase your social security benefit.

While it’s true that you only need to work ten years to be eligible for social security benefits, your social security benefit is actually calculated by taking an average of your highest 35 years of earnings. So if you only work for 15 years and reach full FIRE, never working again, you take a zero for 20 out of the 35 years of your social security calculation.

Alternatively, if you work for 6 or 7 years, reach your coast number and then reduce your workload to cover your living expenses, you are going to get a positive number for each of those years you are working, providing a significant boost to your overall social security benefit at retirement age.

While your Social Security benefit will surely not be enough to cover your entire retirement lifestyle, a small bump in your monthly benefit amount can lead to a significant increase in your total benefit amount over a 20-40 year retirement.

10. You don’t have to wait to work on your terms.

When I came to terms with the fact that I would still want to work when I reached FIRE, it seemed like a no-brainer to start coasting. Why not design the work arrangement I want right now, and start living the FI lifestyle I was aiming for?

This led me to pursue a seasonal tax prep position that offers remote work and 100% control over my schedule combined with freelancing as a personal finance writer the rest of the year. The seasonal tax prep allows me to scale up and down each year throughout the tax season and keeps me learning new things in an industry that I love, with co-workers and an established company. In addition, freelance work lets me flex my creative muscles, do work that lights me up, and offers me the ability to scale work up and down as needed.

In the end, coasting is a simple reframe—you don’t have to go “all-out blitz” on your journey to FIRE, and honestly, it’s probably better if you don’t. Instead, coasting lets you take a more sustainable, mindful, and balanced approach to financial independence, focusing less on the pot of gold and more on the rainbow.

So what do you think? Is coast FIRE the best FIRE?

Let me know why or why not in the comments below.

Yes! Another finely written article. I especially like the points about less risk of social isolation and less risk of burnout.